The 2008 Global Financial Crisis (GFC) has led to a renewed interest in finance, financial instability, and financialisation among geographers and heterodox economists. In this context, capital flows, i.e. financial transactions between residents of different geographical units, have received attention for their potential role in geographically uneven economic dynamics such as local financial booms. In debates on the GFC and the Eurozone crisis, capital flows were associated with current account imbalances, whereby regions with export surpluses such as East Asia and the core Eurozone countries sent capital flows into deficit countries, where they contributed to over-leveraging and asset price bubbles. Similarly, capital flows have been linked to boom-bust cycles and a subordinate form of financialisation in the Global South.

This paper embraces the view that capital flows can be destabilising but argues that previous work has often left unspecified which types of capital flows impact trade, credit, and asset prices, and through what causal mechanisms. There has been a tendency to simply refer to aggregate capital flows without distinguishing between pure gross financial flows and trade-related net flows, and between different types of flows, such as bank and portfolio flows. This is a shortcoming because many gross financial flows are hidden in net and aggregate measures, despite being a potential source of destabilising dynamics such as asset price bubbles.

The paper aims to provide insights into the nature and role of gross financial flows in geographically uneven economic dynamics. Applying a monetary perspective to an international setting, it draws on the theories of endogenous money creation, asset pricing through portfolio choice, as well as Hyman Minsky’s theory of financially fragile balance sheets. The paper utilises coherent balance-sheet accounting to show how capital flows can be tracked between different geographical spaces.

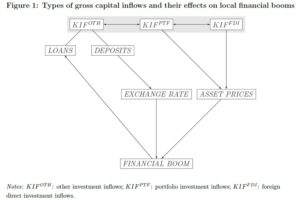

Three main arguments are made. First, trade deficits in a specific region usually are financed endogenously by bank flows that do not have to originate from surplus regions. The focus on net capital flows in much of the previous literature draws attention to surplus regions such as China and Germany, which detracts from financial centres in deficit regions such as New York and London as originators of flows. Second, flows from risk-hungry investors in such global financial centres can indeed drive locally destabilising financial dynamics, but there is no reason to expect loan inflows to do so. By contrast, deposit, portfolio, and FDI flows can directly stimulate exchange rates and domestic asset prices, calling for a more careful distinction of different types of gross flows (Figure 1). Third, gross sudden stops in capital flows can be entirely unrelated to current account deficits but may trigger Minskyan financial instability resulting in negative gross flows rather than outflows. With respect to policy debates, the regulation of international capital flows should therefore not be confined to bank flows and also consider speculative flows into local assets such as real estate.

Source: FinGeo WP31. Kohler, K. (2021) – Capital flows and geographically uneven economic dynamics: a monetary perspective