Central banks, the climate crisis and the need for a ‘creative disruption’

Authors: Martin Sokol and Jennie C. Stephens

_________________________________________________________________________

How should central banks respond to the worsening climate crisis that threatens to destabilise the economy and society? As climate disruptions become more frequent and intense, it seems clear that changes in central banks and their monetary policies are urgently needed. One bold, innovative approach is for central banks to create an intentional disruption of the financial system to change course to allow for major shifts in financial flows. In our recent paper in Climate and Development (Stephens and Sokol, 2023) we argue that a short-term ‘creative disruption’, informed by the principles of ‘climate justice’, could trigger a financial transformation to redirect financial flows and investments toward climate vulnerable communities rather than continuing to reinforce financial markets that benefit wealthy investors and large corporations. Climate justice, an approach to climate action that goes beyond decarbonisation and greenhouse gas emissions reduction (Stephens, 2022), focusses on the urgent need to prioritize social justice and economic equity as a way to reduce climate vulnerabilities. Central banking that is fit for purpose in the age of ‘polycrisis’ needs to embrace climate justice principles as these are fundamental for achieving transformative change towards a more equitable, just, healthy, and sustainable future for all.

This idea of a ‘creative disruption’ goes against the prevailing wisdom about how central banks should respond to climate change risks, which is to maintain financial stability at all costs. Indeed, financial stability is one of the key aims of central banks and their monetary policies. So why would any central bank want to ‘disrupt’ the financial system? The reason is simple; long-term stability requires transformation and transformation requires disruption. The proposal for an intentional ‘creative disruption’ recognises that it does not make sense to keep stabilising an inherently unstable system that is also causing climate chaos. We argue that central banks’ current focus on near-term financial stability is short-sighted because it undermines longer-term stability. The current global financial system is inherently unstable, and decades of financialization has made the system even more crisis-prone. The climate crisis, which is getting worse in part due to central banks’ monetary policy that continues to incentivize and support fossil fuel investments, contributes to expanding inevitable volatility.

While many central banks are increasing their ‘green’ rhetoric, they are still supporting fossil fuel reliance and other investments that are accelerating climate change. In their narrow pursuit of near-term financial stability, the actions of central banks are putting long-term ecological and financial stability at risk. Unless transformative change is made, climate-induced financial crises are inevitable, and these forthcoming crises will have dire consequences for many, especially among those who are already marginalized. Many of the same vulnerable households, communities and regions who are already bearing the brunt of the climate crisis will also suffer the most from forthcoming financial upheavals.

With a ‘climate justice’ approach, a shift away from continuing to prop-up an unjust, inequitable and unstable financial system is essential. Instead of waiting for a climate-related financial calamity to arrive, climate justice principles call for a pro-active, short-term disruption of the financial system, with the aim of securing long-term, durable stability and sustainability. The goal and strategy of such a disruption would be to allow for investments that provide direct support for hard-working families, disadvantaged people and vulnerable communities. While the market economy is well known for its ability to produce ‘creative destruction’, the urgent need for transformative climate justice requires a creative disruption (not destruction).

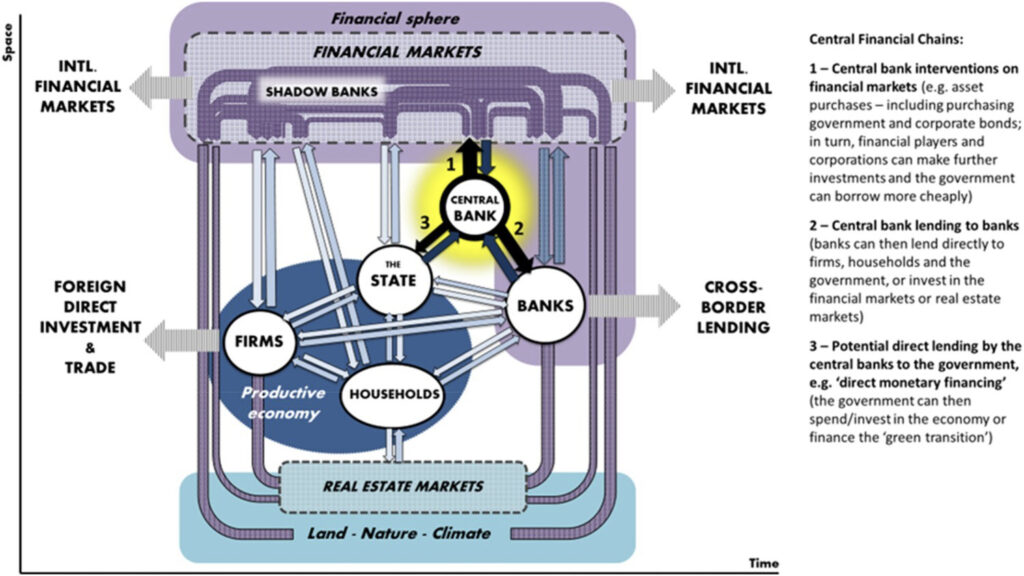

Advocacy for ‘creative disruption’ recognises that central banks now play a central role in managing ‘financial chains’ (Sokol, 2023), a term that refers to the interconnected flow of money and power in financialised economies (see figure). When central banks incentivize financial flows to benefit some and disadvantage others, they are also manipulating the flow of power by empowering some while disempowering others. Transformative climate justice requires disrupting the flows of both money and power, which means managing financial chains in a new and different way. Central banks, therefore, have a key role to play in the much-needed transformative change that is necessary for a better future. Instead of being part of the problem, central banks can become a central part of the solution. The idea of this proposed ‘creative disruption’ is to turn the financial system upside down. Instead of central banks propping up investments in financial markets, central banks could incentivize investments in vulnerable communities, facilitate community wealth-building and support climate resilience. Central banks could promote stability by reversing the existing flows of value and power away from the richest 1% towards workers and families.

There is a growing range of tools in central banks’ toolbox that could be mobilised for this proposed ‘creative disruption’ for climate justice. For example, ‘green’ quantitative easing could be implemented to support urgently needed climate resilience investments. A ‘climate bailout’ could involve central banks acquiring fossil fuel assets in order to close them down. And direct monetary financing of households could be deployed to support the most vulnerable in society. By applying these and other measures (see Stephens and Sokol, 2023, for more), central banks could trigger a rapid phase-out of fossil fuels and redirect the power and influence of financial flows towards a more just, renewable-based future that prioritizes public needs rather than corporate profits.

To steer humanity towards a more stable future, central banks also need to disrupt the self-defeating imperative of endless growth. Given that humanity is pushing past the earth’s planetary boundaries, a new approach to monetary policy aligned with climate justice principles and ecological health will have to be coordinated with a range of other policies as well. This also requires new kinds of global coordination. The urgency for transformative change is growing as climate chaos expands around the world. This change requires new ways of thinking about transforming financial systems. An intentional ‘creative disruption’ triggered by central banks could be the catalyst that is needed to achieve such transformation.

Dr Martin Sokol

Associate Professor

Department of Geography

Trinity College Dublin, Ireland

Email: sokolm@tcd.ie

Prof Jennie C. Stephens

Dean’s Professor of Sustainability Science & Policy

Northeastern University, School of Public Policy & Urban Affairs, Boston, MA USA

Climate Justice Fellow at Harvard-Radcliffe

https://www.jenniecstephens.com/

Figure: Central banks and financial chains in a financialised economy

(Source: Stephens and Sokol, 2023)

References:

Sokol, M. (2023). Financialisation, central banks and ‘new’ state capitalism: The case of the US Federal Reserve, the European Central Bank and the Bank of England. Environment and Planning A: Economy and Space, 55(5), 1305-1324. https://doi.org/10.1177/0308518X221133114

Stephens, J. C. (2022). Feminist, Antiracist Values for Climate Justice: Moving Beyond Climate Isolationism. In J. Agyeman, T. Chung-Tiam-Fook, & J. Engle (Eds.), Sacred Civics: Building Seven Generation Cities. Routledge.

Stephens, J. C., and Sokol, M. (2023). Financial innovation for climate justice: central banks and transformative ‘creative disruption’. Climate and Development, 1-12. https://doi.org/10.1080/17565529.2023.2268589

_________________________________________________________________________

Acknowledgements:

This blog was originally published as GEOFIN blog #16 (see https://geofinresearch.eu/outputs/blog/ ). GEOFIN project received funding from the European Research Council (ERC) Consolidator Grant under the European Union’s Horizon 2020 research and innovation programme (Grant Agreement No. 683197).