– Ewa Karwowski –

Some academics and economic commentators have argued that we are living in an age of ‘de-globalisation’. Given a looming no-deal Brexit and the lunacy of the Trump presidency—especially considering their impacts on international trade, regional integration and global governance—this view is not too far-fetched. However, the de-globalisation argument draws heavily on a (Global North) rich-country perspective and focuses on trade flows. If we shift our viewpoint to emerging economies (EMEs) —that is, those countries that have experienced an economic transformation, for instance from planned to market economies or from low-income to middle-income status— and financial flows rather than trade a very different picture arises.

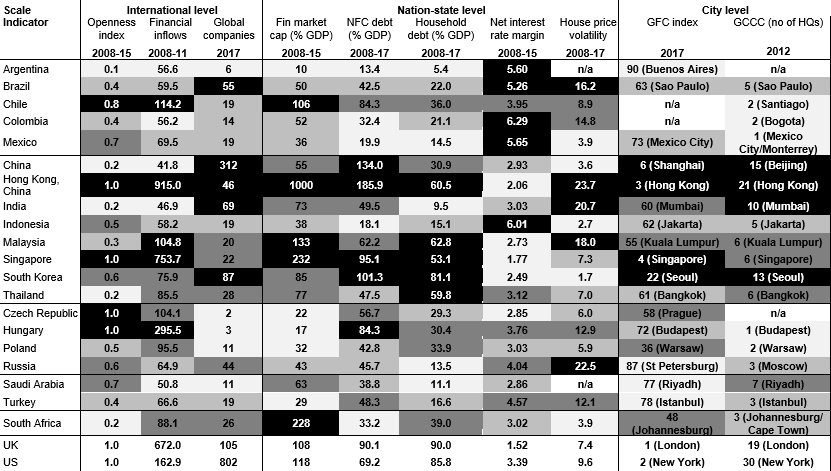

Since the financial crisis, economic development in EMEs has been shaped by financialization, meaning by the structural transformation of financial markets through which production of goods and services loses out or becomes subordinated to financial accumulation. While it is generally acknowledged that financialization takes on a different and distinct form in the Global South, I argue that it is importantly variegated within this country group, that is, across EMEs. To help identify the determinants of this variegation, the paper discusses financialization with respect to nine dimensions on three geographical scales: the urban (or city) level, the nation state and the international scale. These financialization dimensions are: (1) financial liberalization, (2) financial globalization, (3) the presence of globally operating companies, (4) the financialization of the financial sector, (5) non-financial companies (NFCs), (6) households and (7) the state; as well as (8) asset price inflation and (9) the existence of financial centres. In this way, links are created across important financialization research strands, especially economic geography, political economy and heterodox economics.

Thus, the paper takes stock of the structural and spatial variegation of financialization in 20 EMEs, by reviewing the phenomenon on the international, state and city level. When comparing measures of financialization in EMEs, we observe a strong degree of variegation across but also within regions. The table provides the nine dimensions of financialization for 20 EMEs, showing relative positions through colour coding. Values ranked within the top quartile of an indicator are highlighted in black, symbolising a strong degree of financialization. Positions in the second quartile are highlighted in dark grey, while the lower ranks are represented in light greys. The least degree of financialization for a given indicator are marked in off-white. The UK and US are included as points of reference.

Financialization indicators across twenty emerging economies and three scales

The full article and working paper series can be found aqui.