—Michael A. Urban, Vladimír Pažitka, Stefanos Ioannou and Dariusz Wójcik—

The concept of economic resilience finds its roots in resilience thinking in ecology. As a result, much of the resilience literature tends to assume that sectoral and regional resilience are determined by the characteristics of regions and sectors such as their productivity, their labor skills or their policy regime. In this paper, we take a different approach and postulate that under certain conditions, the resilience of industrial sectors, and indeed whole socio-economic systems, can be reflexively tied to the agency and power of lead firms. We substantiate our argument through an in-depth study of the role of Goldman Sachs, a leading US investment bank, in shaping the resilience of the US financial sector in the lead up to, during, and out of the global financial crisis.

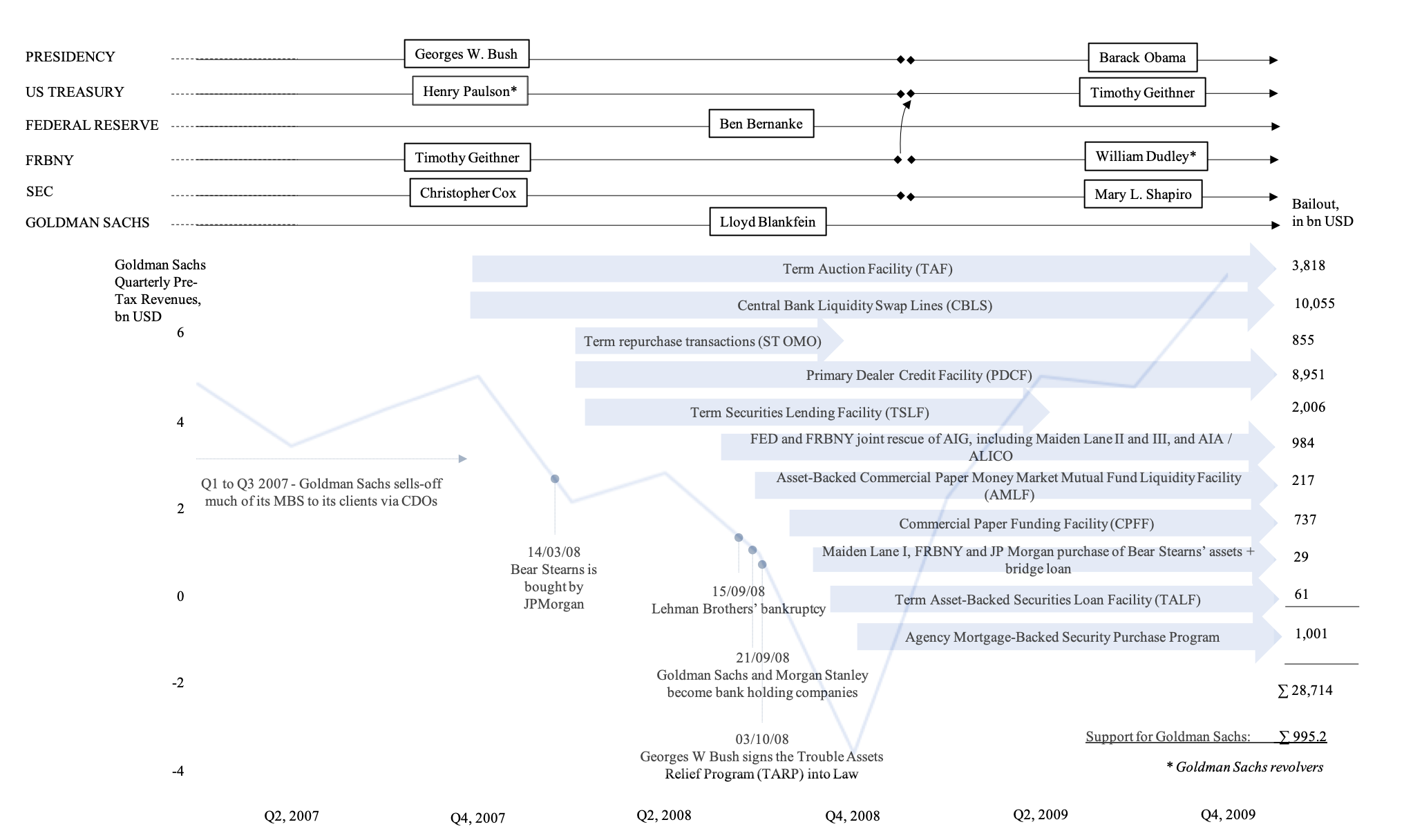

We present our analysis for three key periods. In the first part, we show that Goldman’s pre-crisis rise to prominence (1999 to 2006) is linked to the firm’s strategic move to aggressively securitize and trade in the booming US real estate market. As such, Goldman Sachs contributed significantly to the build-up of systemic market risk. Evidence suggests that in 2006, when legislators, regulators and the rest of the US securities industry seemed fast asleep at the wheel, Goldman showed remarkable foresight in spotting early signs of the imminent collapse of the US real estate market. As a result, the company was swift to offload much of its exposure to subprime securities in a move that would spark much controversy on the legality and morality of investment bankers selling securities they deem worthless.

Although Goldman’s intuition proved to be right, the firm nonetheless underestimated the interconnectedness of the US financial sector. Following Lehman Brothers’ bankruptcy, Goldman’s fate, not unlike a number of other globally-systemically important financial institutions, came to depend on government agencies. Building on multiple sources of evidence, the second part of our analysis (2007 to 2009) focuses on revealing the deep interconnections between Goldman Sachs and policy-makers and regulators and the significant agency of the former in negotiating the latter’s crisis-response. We document Goldman Sachs’ role in these negotiations and show the firm’s tireless efforts to promote its interests and steer regulators and government agencies to avoid both failure and reforms. Although Goldman made every possible effort to distance itself from the idea that it was bailed out, we show that it was one of the largest recipients of government aid.

The resilience of Goldman Sachs to the global financial crisis

Sources: Authors’ calculations based on Felkerson (2011) and FCIC (2011).

In the third part of our analysis (2010 to 2017), we document and analyse Goldman Sachs’ post-crisis corporate reorganization. We show that since the crisis Goldman has become even more global and diversified. Today, its extensive network of 61 offices spans every corner of the globe including all the leading global financial centres as well as emerging financial centres focused on mid- and back-office operations as well as technology, such as Salt Lake City and Bengaluru. The latter locations are becoming core strategic locations for the firm’s global operations; we discuss this geographical shift in light the technological intensification of the sector.

Overall, our analysis sheds light on the role of lead firms in the process of negotiating an economic crisis with reference to firm level strategic management and lead firms’ agency in influencing their political and regulatory milieu. Our results show that Goldman Sachs did not come out of the crisis unscathed or unchanged; yet, they also suggest that its staying power is as much due to its ability to adapt to a changing environment as it is to its capacity to shape it. Ultimately, our analysis implies that Goldman Sachs’ efforts to ensure its own survival had wider consequences for the survival of other key companies in the financial sector and by extension the resilience of the financial sector as a whole.