Some people might consider the ‘brick-and-mortar’ bank branch to be an obsolete concept destined to become extinct. Almost every decade, it has been predicted that technology will render the physical presence of banks unnecessary. However, the bank branch has yet to be replaced as the primary source of soft information with an intrinsic spatial dimension. In addition, the bank branch often fulfills other important roles aside from its core function, since it contributes to the accumulation of regional social capital or the physical manifestation of financial inclusion drawing attention to uneven geographical development. The bank branch still represents an important distributional channel, the closure which can have severe consequences for the local economy.

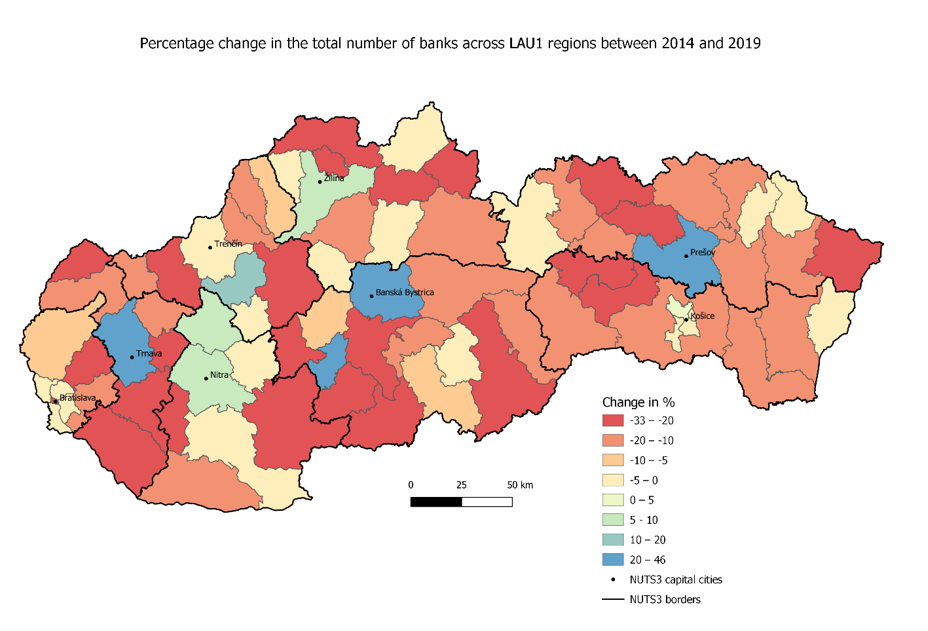

In our working paper, we argue that to understand better the heterogeneous impact of bank network structure on the local economy, one must examine the deviations from local equilibria. Our main variable of interest is the cost of debt of SMEs, approximated by the effective interest rate calculated from firms’ financial statements. To study the nonlinear relationship between local credit market structures and SMEs’ costs of debt, we focus on the Slovak banking system because of a few of its distinct features. Figure 1 shows the change in the total number of banks across Slovak LAU1 regions between observed time periods.

Figure 1

Source: own elaboration

To investigate the nonlinear effects of access to finance via a ‘brick-and-mortar’ bank branch-network, we adopt a two-step approach. In the first step, we construct an empirical model of bank branch localization that allows us to calculate fundamentally driven optimal levels of credit market saturation. We use a panel data model with random effects and bootstrapped standard errors. Determinants of this optimal level are drawn from the literature on bank branch localization. In the second step, we separately investigate the effects of positive and negative deviations from the optimal level of market saturation (under- and over-branching) on the costs of firms’ bank debt. In addition, we analyse the specific features of SMEs that are associated with the most severe effects of limited access to finance and the qualitative characteristics of banks that could potentially mitigate the consequences of the ‘too-much-branching’ phenomenon. We again employ a panel data model with random effects and bootstrapped standard errors. From an econometric point of view, the two-step approach also has the advantage of mitigating the effect of potential endogeneity in the presence of the changing nature of the underlying bank network structure.

Our results reveal several important findings. First, we find that the bank branch-network size affects the costs of SMEs debt unequally depending on the level of credit market saturation. Firms mostly affected by such a nonlinear relationship, located in under-branched regions, are usually medium-sized, with domestic ownership and operation in low-tech industries. Conversely, in over-saturated markets, bank characteristics gain importance as the source of competition in quality rather than sheer expansion of the bank network. Finally, we show that while the spatial structure of the bank branch-network in Slovakia reflects standard socio-economic factors, the role of geographical elements remains unsubstitutable.