– Sabine Dörry, Gary Robinson and Ben Derudder –

A decade on from the financial crisis, it has become common practice to look back on what has happened since. Much of the focus has been on the regulatory response towards systemically important financial institutions who are too-big-to-fail. However, another group of systemically important actors has received less attention: financial markets infrastructure (FMI).

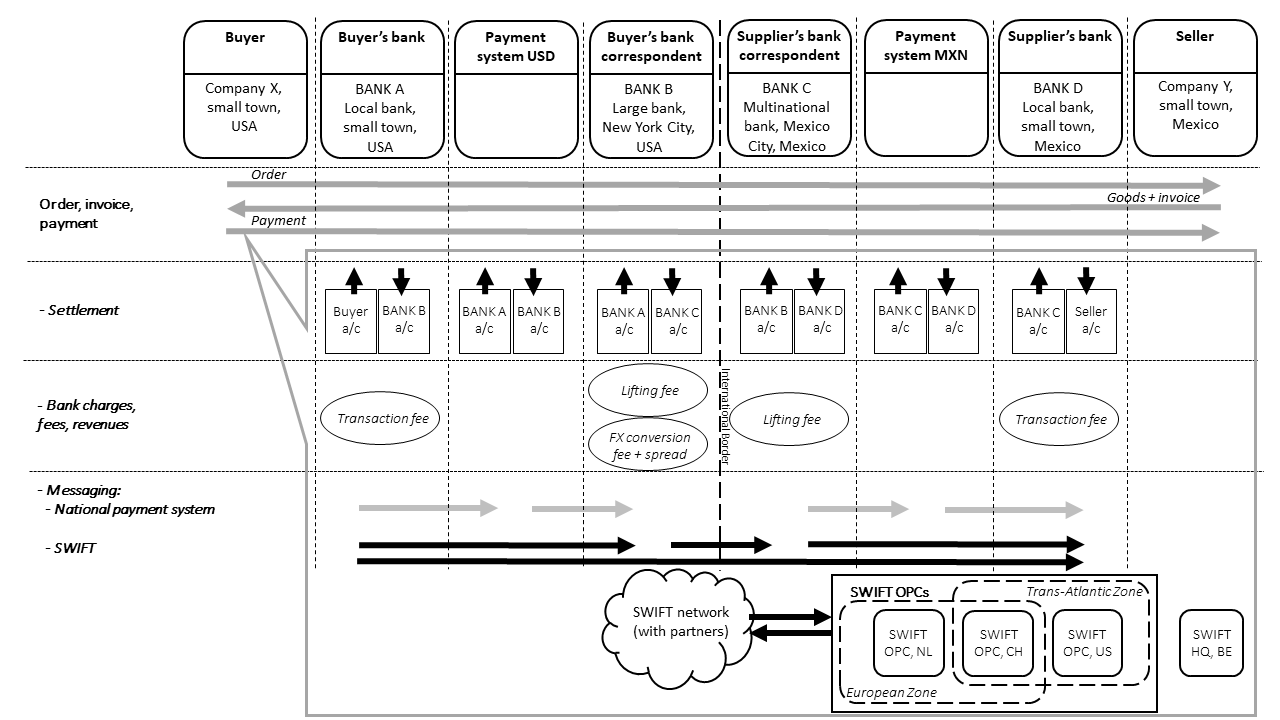

Commonly referred to as the financial “plumbing”, FMI is the backbone of the global financial system, yet to-date has received little attention from financial geographers. It comprises functions and services such as clearinghouses and securities depositories as well as processes and systems for payments, clearing and settlement. In our paper, we focus on the ‘mundane’ yet highly profitable and strategically important area of payments. In so doing, we zoom in on a singular and crucially important actor, the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

SWIFT is perhaps best known for the old names of the bank codes used in international payments. Such payments are underpinned by the correspondent banking system, a means by which banks provide and access services in other jurisdictions via banks in those locations. This system constitutes a historical fundament of the network of IFCs dating back hundreds of years. While the logic of this system hasn’t changed since, the Eurodollar-enabled expansion of Western banks in the 1970s raised a need to more efficiently deal with the increased volume of transactions. SWIFT was thus formed as a co-operative by banks to accomplish this and is now the near-monopoly provider of financial messaging for payments.

As SWIFT’s genesis is inextricably associated with cross-border payments and this still forms the core of its business, one of the things we do in our paper is to examine closely how such payments work. We use global production networks (GPN) to look ‘under the hood’ of an international, or more accurately, a cross-currency payment. Doing so allows us to see the network of actors involved, but also to consider the significance of where global economic activities occur.

The anatomy of an international payment via correspondent banking

Source: Own illustration

Based on European Central Bank (2017); Gifford and Cheng (2016);McCune (2014); SWIFT (2016; 2018).

SWIFT’s role as both intermediary between financial actors and infrastructure for the global financial system makes it more than a mere passive facilitator of economic activity. Its governance system is weighted in favour of its heaviest users—Western, and in particular US, banks—and its embeddedness in particular locations make it subject to political influence. This is evident in some controversies that SWIFT has been involved in, for example, its ‘weaponization’ in imposing sanctions on some states at the behest of others. Hence, because SWIFT is a key infrastructure provider of global geo-political and geo-economic importance, we show how SWIFT forms a carefully crafted socio-economic system in itself, which can also be defined as an intermediary in the GPNs of finance.

The strategic importance of FMI has lately become more apparent to politicians, and in our working paper, we make the case too for financial geographers to examine infrastructure actors’ role in shaping the architecture of the financial system. Read the full paper here.